New Delhi, Sept 4, 2025| SKY LINK TIMES

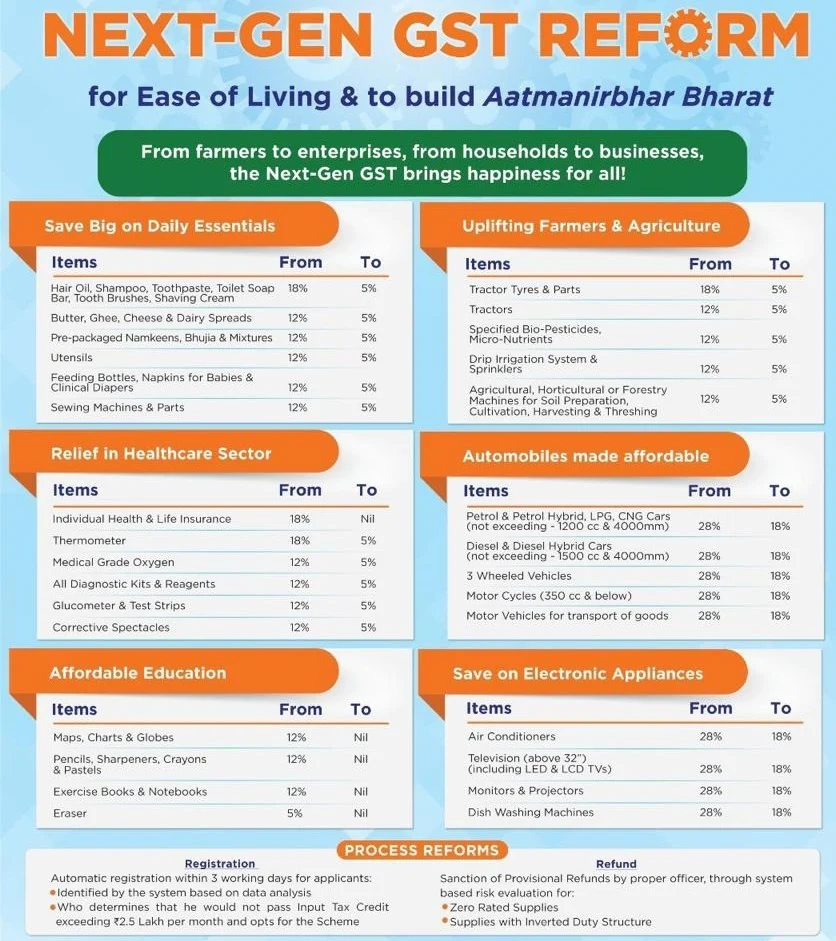

GST Council at its 56th meeting has approved sweeping rate cuts and rationalisation of slabs. Finance Minister Nirmala Sitharaman, briefing the media, said these reforms mark a new phase of India’s indirect tax regime, with focus on affordability, healthcare, agriculture, and labour-intensive industries.

Table of Contents

Key Highlights of GST Council’s Rate Cuts

- Insurance (NIL GST):

- All individual life insurance policies (term life, ULIP, endowment).

- All individual health insurance policies, including family floater & senior citizen plans.

- Reinsurance of such policies.

- Medicines & Medical Devices:

- 33 life-saving drugs: GST cut from 12% → NIL.

- 3 cancer & rare disease drugs: GST cut from 5% → NIL.

- Other medicines: 12% → 5%.

- Medical apparatus & devices: 18% → 5%.

- Daily Essentials (5% GST):

- Hair oil, soaps, shampoos, toothbrushes, toothpaste.

- Kitchen & household articles, bicycles.

- Food items: namkeen, bhujia, sauces, pasta, instant noodles, chocolates, coffee, cornflakes, preserved meat, butter, ghee.

- Zero GST on:

- Ultra-high temperature (UHT) milk.

- Chena and paneer.

- All Indian breads.

- Consumer Durables & Automobiles:

- GST cut from 28% → 18% on ACs, televisions, dishwashers, small cars, and motorcycles.

- Agriculture & Farmers:

- All agricultural equipment: 12% → 5%.

Structural Reform in GST Slabs

- 4 slabs reduced to 2 slabs:

- 5% and 18% retained.

- 12% and 28% scrapped.

ALSO READ: GST Collections Rise 6.5% in August to Rs 1.86 Lakh Crore (skylinktimes.in)

Financial & Economic Impact

- Estimated revenue impact: ₹48,000 crore, termed “fiscally sustainable” by Revenue Secretary Arvind Shrivastava.

- The reform corrects inverted duty structures, resolves classification disputes, and provides greater predictability for businesses.

Political & Administrative Backing

- The meeting was chaired by FM Nirmala Sitharaman with MoS Finance Pankaj Chaudhary, CMs of Delhi, Goa, Haryana, J&K, Meghalaya, and Odisha, and Deputy CMs of several states.

- Prime Minister Narendra Modi was credited with setting the tone for next-gen tax reforms.

Effective Date

📌 All new GST rates will take effect from September 22, 2025 (Navratri Day).

For More Info Stay Tuned: https://skylinktimes.in